Bachmann: "Failed Stimulus," And Unemployment "Spiked"

BACHMANN: Unfortunately, the President's strategy for recovery was to spend a trillion dollars on a failed stimulus program, fueled by borrowed money.[...] Not only did that plan fail to deliver, but within three months the national jobless rate spiked to 9.4 percent. And sadly, it hasn't been lower for 20 straight months. While the government grew, we lost more than 2 million jobs. Let me show you a chart. Here are unemployment rates over the past ten years. In October 2001, our national unemployment rate was at 5.3 percent. In 2008 it was at 6.6 percent. But, just eight months after President Obama promised lower unemployment, that rate spiked to a staggering 10.1 percent.

Unemployment Didn't "Spike" — It Grew Steadily Under Bush-Era Policies...

The Economy Shed Almost 8 Million Jobs Under Republican Policies Before The Recovery Act Could Affect The Economy. According to economist Robert J. Shapiro:

From December 2007 to July 2009 - the last year of the Bush second term and the first six months of the Obama presidency, before his policies could affect the economy - private sector employment crashed from 115,574,000 jobs to 107,778,000 jobs. Employment continued to fall, however, for the next six months, reaching a low of 107,107,000 jobs in December of 2009. So, out of 8,467,000 private sector jobs lost in this dismal cycle, 7,796,000 of those jobs or 92 percent were lost on the Republicans' watch or under the sway of their policies. Some 671,000 additional jobs were lost as the stimulus and other moves by the administration kicked in, but 630,000 jobs then came back in the following six months.

The tally, to date: Mr. Obama can be held accountable for the net loss of 41,000 jobs (671,000 - 630,000), while the Republicans should be held responsible for the net losses of 7,796,000 jobs. [Sonecon.com,

8/10/10, emphasis added]

Based on Shapiro's research, the Washington Post's Ezra Klein created the following chart showing net job losses before and after the Recovery Act was enacted:

- From December 2007 Through July 2009, Economy Lost Nearly 400,000 Private Sector Jobs Per Month On Average. According to Bureau of Labor Statistics data on monthly gains and losses in private sector jobs, the private sector added 23,000 jobs in December 2007. In June 2009, the sixth month of the Obama presidency, the private sector shed 452,000 jobs. Over that 19-month span, the private sector shed 393,000 jobs per month on average, the data show.

Dec 07 | 23,000 |

Jan 08 | -12,000 |

Feb 08 | -85,000 |

Mar 08 | -58,000 |

Apr 08 | -161,000 |

May 08 | -253,000 |

Jun 08 | -230,000 |

Jul 08 | -257,000 |

Aug 08 | -347,000 |

Sep 08 | -456,000 |

Oct 08 | -547,000 |

Nov 08 | -734,000 |

Dec 08 | -667,000 |

Jan 09 | -806,000 |

Feb 09 | -707,000 |

Mar 09 | -744,000 |

Apr 09 | -649,000 |

May 09 | -334,000 |

Jun 09 | -452,000 |

AVG | -393,000 |

PolitiFact: "True" That "Most Job Losses" Happened Before Obama Policies Took Effect. According to PolitiFact.com's analysis of President Obama's statement that "most of the jobs that we lost were lost before the economic policies we put in place had any effect": "Looking at BLS data on seasonally adjusted non-farm employment from December 2007,

when the recession officially began, to January 2009, the month before the stimulus was enacted (a 25-month period), the jobs number declined by 4.4 million. ... When [Obama] refers to his economic policies, we presume he is referring to his main economic stimulus, the American Recovery and Reinvestment Act.

It passed in February 2009, but it took several months before the impact of its spending was felt in the economy. Job loss didn't stop, but Obama is right that it slowed down. In the 19 months from February 2009 through September 2010, the month of the most recent preliminary data, the overall job decline in the private and public sectors was 2.6 million. And the number of jobs lost per month has declined from around 700,000 a month at the beginning of the administration to months in which there were small net gains. ... 'I watched the president on Stewart's show last night, and I thought his basic point about the timing of the employment losses was correct and ought to be noncontroversial,' Gary Burtless, a labor markets expert at the centrist-to-liberal Brookings Institution said in an e-mail." [PolitiFact.com,

10/27/10, emphasis added]

...Until Obama Policies Began To Take Effect

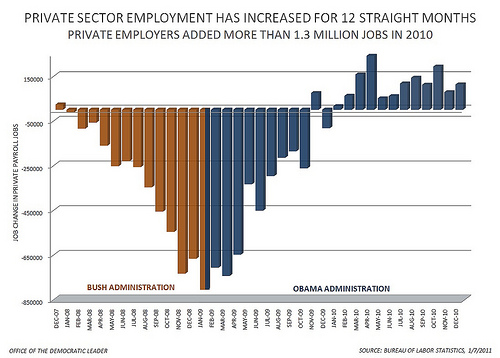

The private sector jobs-per-month chart below, based on Bureau of Labor Statistics data, is shaded red for months before economists say President Obama's policies began to impact the economy, and blue for subsequent months.

The Private Sector Has Added Jobs Every Month Since December 2009. According to Bureau of Labor Statistics data, the private sector shed 83,000 jobs in December 2009. Since then, the lowest monthly job gain was 16,000 in January 2010, and the highest was 241,000 in April 2010; private industries have added jobs for 12 straight months, the data show. [BLS.gov, accessed

1/23/11]

Private Sector Grew By 1.3 MILLION Jobs In 2010. Below is a graph prepared by Minority Leader Pelosi's office showing net private sector job gains or losses per month since December 2007.

[DemocraticLeader.gov,

1/7/11]

CBO: The Recovery Act Created Jobs, Lowered Unemployment, And Boosted GDP. According to the nonpartisan Congressional Budget Office:

CBO estimates that ARRA's policies had the following effects in the third quarter of calendar year 2010:

- They raised real (inflation-adjusted) gross domestic product by between 1.4 percent and 4.1 percent,

- Lowered the unemployment rate by between 0.8 percentage points and 2.0 percentage points,

- Increased the number of people employed by between 1.4 million and 3.6 million, and

- Increased the number of full-time-equivalent (FTE) jobs by 2.0 million to 5.2 million compared with what would have occurred otherwise. (Increases in FTE jobs include shifts from part-time to full-time work or overtime and are thus generally larger than increases in the number of employed workers). [CBO, November 2010]

Princeton, Moody's Economists Say "Highly Effective" Government Response To Crisis Saved 8.5 Million Jobs. According to the

New York Times: "Like a mantra, officials from both the Bush and Obama administrations have trumpeted how the government's sweeping interventions to prop up the economy since 2008 helped avert a second Depression. Now, two leading economists wielding complex quantitative models say that assertion can be empirically proved.

In a new paper, the economists argue that without the Wall Street bailout, the bank stress tests, the emergency lending and asset purchases by the Federal Reserve, and the Obama administration's fiscal stimulus program, the nation's gross domestic product would be about 6.5 percent lower this year. In addition, there would be about 8.5 million fewer jobs, on top of the more than 8 million already lost; and the economy would be experiencing deflation, instead of low inflation. The paper, by

Alan S. Blinder, a Princeton professor and former vice chairman of the Fed, and

Mark Zandi, chief economist at Moody's Analytics, represents a first stab at comprehensively estimating the effects of the economic policy responses of the last few years. 'While the effectiveness of any individual element certainly can be debated, there is little doubt that in total, the policy response was highly effective,' they write." [

New York Times,

7/27/10, emphasis added]

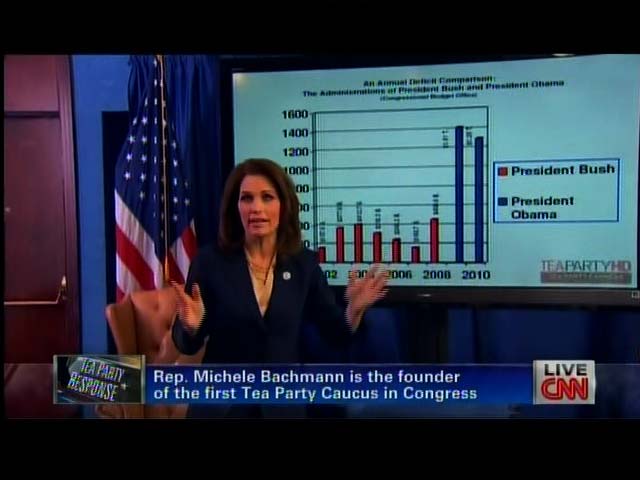

Bachmann Wrongly Blamed President Bush's Final Year Of Deficits On President Obama

BACHMANN: But, instead of cutting, we saw an unprecedented explosion of government spending and debt, unlike anything we have seen in the history of our country. Deficits were unacceptably high under President Bush, but they exploded under President Obama's direction, growing the national debt by an astounding $3.1 trillion-dollars.

Bachmann supported her claim with a chart that wrongly attributes the FY 2009 deficit to President Obama:

The Exploding Debt And Deficit Are The Result Of Bush-Era Policies And The Recession

Before Obama Took Office, The FY 2009 Deficit Was Projected At $1.2 Trillion. As reported by the

Washington Times: "

The Congressional Budget Office announced a projected fiscal 2009 deficit of $1.2 trillion even if Congress doesn't enact any new programs. [...] About the only person who was silent on the deficit projection was Mr. Bush, who took office facing a surplus but who saw spending balloon and the country notch the highest deficits on record." [

Washington Times,

1/8/09, emphasis added]

CBPP: Deficit Grew By $3 TRILLION Because Of Policies Passed From 2001 To 2007. According to the Center on Budget and Policy Priorities: "Congressional Budget Office data show that the tax cuts have been the single largest contributor to the reemergence of substantial budget deficits in recent years. Legislation enacted since 2001 added about $3.0 trillion to deficits between 2001 and 2007, with nearly

half of this deterioration in the budget due to the tax cuts (about a third was due to increases in security spending, and about a sixth to increases in domestic spending)." [CBPP.org, accessed

1/31/10, parentheses original]

The Bush Tax Cuts Are The Primary Driver Of Federal Budget Deficits Over The Next Decade.Below is a chart from CBPP showing the deficit impacts of war spending, financial recovery spending, the recession itself, and the Bush tax cuts:

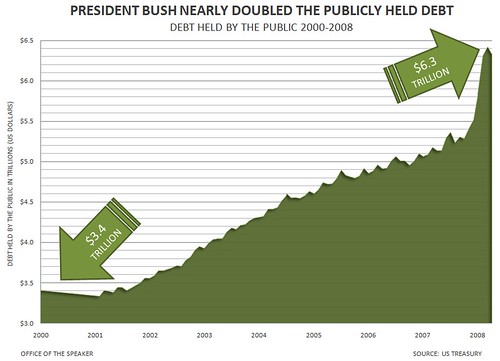

Debt Skyrocketed While Bush Was In Office. Below is a graph prepared by Minority Leader Pelosi's office showing the increase of public debt during the years Bush was in office:

[U.S. Treasury via Flickr.com, accessed

1/25/11]

Bachmann Repeated "16,500" IRS Agents' Lie

BACHMANN: What did we buy? Instead of a leaner, smarter government, we bought a bureaucracy that tells us which light bulbs to buy, and which will put 16,500 IRS agents in charge of policing President Obama's healthcare bill.

"16,500 IRS Agents" A False Claim Based On Partisan Analysis Of Bill

FactCheck.org: "This Wildly Inaccurate Claim Started As An Inflated, Partisan Assertion." In a fact check of various Republican claims about thousands of new, armed IRS agents required by the Affordable Care Act, the non-partisan FactCheck.org wrote:

Q: Will the IRS hire 16,500 new agents to enforce the health care law?

A: No. The law requires the IRS mostly to hand out tax credits, not collect penalties. The claim of 16,500 new agents stems from a partisan analysis based on guesswork and false assumptions, and compounded by outright misrepresentation...

This wildly inaccurate claim started as an inflated, partisan assertion that 16,500 new IRS employees might be required to administer the new law. That devolved quickly into a claim, made by some Republican lawmakers, that 16,500 IRS "agents" would be required. Republican Rep. Ron Paul of Texas even claimed in a televised interview that all 16,500 would be carrying guns. None of those claims is true. [FactCheck.org,

3/30/10; emphasis original]

FactCheck.org: Claim Based On Bad Assumptions In Misleading Republican Staff Report. In a fact check of various Republican claims about thousands of new, armed IRS agents required by the Affordable Care Act, the non-partisan FactCheck.org wrote:

This figure originated with a report put out by Republicans on the House Ways and Means Committee on March 18...The analysts based their 16,500 figure on an assumption that the IRS budget "could" require an additional $10 billion over the next 10 years as a result of the law, a figure they attribute to the Congressional Budget Office...The GOP analysts then inflated their estimate by making a couple of false assumptions.

No desks? First, they assume that all the new "administrative" spending projected by CBO would go for payroll and benefits - without any allowance for desks, computers, office rent, utilities, travel or other overhead costs necessary to run any government enterprise. The partisan analysts simply divided the spending (which they figured could be $1.5 billion per year once the law is fully effective) by the current average payroll cost for the entire IRS workforce...The GOP analysts then inflated their estimate by making a couple of false assumptions.

No pay raises? The second false assumption is that there will be no inflation or pay raises over the next decade. They apply fiscal 2009 cost figures to budgets for 2014 through 2019. In fact,CBO currently projects that the Employment Cost Index will rise 1.4 percent next year and reach 3 percent per year in 2015 and thereafter. Even if the partisan analysis is valid, that would further reduce the maximum number that could be hired by another 1,000 in 2014, and by about 2,800 in 2019, by our calculations. [FactCheck.org,

3/30/10; emphasis original]

Bachmann: Repeal Affordable Care Act, Or "Be Forced To Rely On Government-Run Coverage"

BACHMANN: In the end, unless we fully repeal ObamaCare, a nation that currently enjoys the world's best healthcare may be forced to rely on government-run coverage that will have a devastating impact on our national debt for generations to come.

There Is No "Government-Run Coverage" In The Affordable Care Act

PolitiFact: Law "Relies Largely On The Free Market." As reported by PolitiFact.com:

"Government takeover" conjures a European approach where the government owns the hospitals and the doctors are public employees. But the law Congress passed, parts of which have already gone into effect, relies largely on the free market:

• Employers will continue to provide health insurance to the majority of Americans through private insurance companies.

• Contrary to the claim,

more people will get private health coverage. The law sets up "exchanges" where private insurers will compete to provide coverage to people who don't have it.

•

The government will not seize control of hospitals or nationalize doctors.

• The law does not include the public option, a government-run insurance plan that would have competed with private insurers.

• The law gives tax credits to people who have difficulty affording insurance, so they can buy their coverage from private providers on the exchange.

But here too, the approach relies on a free market with regulations, not socialized medicine. [PolitiFact.com,

12/16/10, emphasis added]

Non-Partisan Fact Checkers PolitiFact.com Named "Government Takeover Of Health Care" Their "Lie Of The Year" For 2010. According to PolitiFact: "In the spring of 2009, a Republican strategist settled on a brilliant and powerful attack line for President Barack Obama's ambitious plan to overhaul America's health insurance system.

Frank Luntz, a consultant famous for his phraseology, urged GOP leaders to call it a 'government takeover.' 'Takeovers are like coups,' Luntz wrote in a 28-page memo. 'They both lead to dictators and a loss of freedom.' The line stuck. By the time the health care bill was headed toward passage in early 2010, Obama and congressional Democrats had sanded down their program, dropping the 'public option' concept that was derided as too much government intrusion.

The law passed in March, with new regulations, but no government-run plan. But as Republicans smelled serious opportunity in the midterm elections, they didn't let facts get in the way of a great punchline. And few in the press challenged their frequent assertion that under Obama, the government was going to take over the health care industry

. PolitiFact editors and reporters have chosen 'government takeover of health care' as the 2010 Lie of the Year." [PolitiFact.com,

12/16/10, emphasis added]

Bachmann Claimed The Affordable Care Act Doesn't Allow Insurance Sales Across State Lines

BACHMANN: And, the President should repeal ObamaCare and support free market solutions like medical malpractice reform and allow all Americans to buy any healthcare policy they like anywhere in the United States.

Health Care Reform Already Permits Insurance Sales Across State Lines

The Affordable Care Act Allows The Sale Of Insurance Across State Lines Via Compacts. From the Urban Institute: "

Interstate sales of health insurance are permitted under PPACA, but only between states entering into explicit joint insurance compacts developed for this purpose. The law's minimum levels of insurance regulations, which will apply to all states and its limitation of cross-state sales to those joining compacts, will provide greater consumer protections than would have been the case under prior proposals." [Urban Institute,

August 2010, emphasis added]

Health Care Compacts Ensure Consumer Protection While Increasing Interstate Competition.According to the Kaiser Family Foundation, the Affordable Care Act will "[

p]ermit states to form health care choice compacts and allow insurers to sell policies in any state participating in the compact. Insurers selling policies through a compact would only be subject to the laws and regulations of the state where the policy is written or issued,

except for rules pertaining to market conduct, unfair trade practices, network adequacy, and consumer protections.Compacts may only be approved if it is determined that the compact will provide coverage that is at least as comprehensive and affordable as coverage provided through the state Exchanges. (Regulations issued by July 1, 2013, compacts may not take effect before January 1, 2016)" [Kaiser Family Foundation,

6/18/10, emphasis added]

Interstate Insurance Sales Are Only An Effective Cost-Control Mechanism With Consumer Protections In Place

Without Protections In The Affordable Care Act, Portability Would Increase Insurance Costs For The Old And Sick. From the Urban Institute:

Under the earlier proposals, insurers could sell coverage to residents of any state, with the insurer complying with insurance regulations in the state in which the company was based, instead of the regulations of the state in which the consumer lived. Several researchers analyzed these proposals within the context in which they had been proposed-that is, without other insurance market reforms or significant subsidization of coverage for the low-income population.

All three analyses reached similar conclusions. [...]

While these policies, absent other insurance regulatory reforms, could provide lower-cost insurance options for healthier and younger individuals living in more highly regulated states, the savings would come at the price of increasing insurance costs for older adults and those in less than perfect health. Insurance could also be expected to become less comprehensive across the board in such a context, leading to higher out-of-pocket burdens on those using health care services. [Urban Institute,

August 2010, emphasis added, internal citation deleted for clarity]

Insurance Plans Are Currently Regulated By States. From Ezra Klein's

Washington Post blog: "Insurance is currently regulated by states. California, for instance, says all insurers have to cover treatments for lead poisoning, while other states let insurers decide whether to cover lead poisoning, and leaves lead poisoning coverage -- or its absence -- as a surprise for customers who find that they have lead poisoning. ... The result of this is that an Alabama plan can't be sold in, say, Oregon, because the Alabama plan doesn't conform to Oregon's regulations." [

Washington Post,

2/17/10]

Portability Without National Consumer Protection Would Effectively Eliminate Regulations On Insurance. From the

New Republic: "The young and healthy would save money because they'd find an insurance plan from a state with very limited regulation. Say, those plans would operate in a state that doesn't require insurance to cover any medical conditions that are unlikely to afflict a young, healthy 25-year-old. What happens is that the health care industry becomes like the credit card industry. Some small state realizes it can attract a lot of business its way by winning the race to the regulatory bottom. So then, effectively, we've almost completely eliminated all regulations on health insurance." [

New Republic,

2/17/10]

Regulations Keep Insurance Affordable For People Who Most Need Coverage. From the

New Republic: "[T]he effect of those regulations was to force insurers to cover medical conditions that older or less healthy people have. As a result, all the young healthy people have split, and costs on everybody else go up. The young and healthy are paying higher rates because of these regulations. But the same regulations let the old and sick pay lower rates -- and they're the people who have the biggest trouble buying insurance as it is. Allowing interstate sale of insurance isn't just a non-solution, it's a massive anti-solution, worsening all the problems of the status quo." [

New Republic,

2/17/10]

Bachmann Got It Wrong On Corporate Tax Rates

BACHMANN: We need to start making things again in this country. And we can do that by reducing the tax and regulatory burden on job creators. America will have the highest corporate tax rate in the world. Think about that.

American Corporations Do Not Actually Pay The Highest Corporate Tax Rate In The World, And President Obama Called For Lowering Statutory Corporate Tax Rates In His Address

President Obama Called For Reducing The Corporate Tax Rate In His Speech. During his State of the Union address, President Obama said:

Over the years, a parade of lobbyists has rigged the tax code to benefit particular companies and industries. Those with accountants or lawyers to work the system can end up paying no taxes at all. But all the rest are hit with one of the highest corporate tax rates in the world. It makes no sense, and it has to change.

So tonight, I'm asking Democrats and Republicans to simplify the system. Get rid of the loopholes. Level the playing field. And use the savings to

lower the corporate tax rate for the first time in 25 years- without adding to our deficit. [Obama State of the Union Address,

1/25/11, emphasis added]

Effective Tax Rates Are Lower Than Statutory Rates. In its 2009 report on global taxation, the World Bank wrote: "The key point to recognise is that it is not simply the statutory rate of corporate income tax that is important here, but also the effective tax rate for current corporate income tax, taking into account all the additions and deductions to profit before tax that tax rules may require." ["Paying Taxes 2009: The Global Picture," World Bank,

11/10/08]

American Companies Pay Lower Effective Tax Rate Than German, Canadian, Chinese, Italian, And Other Companies. In its 2009 report on global taxation, the World Bank wrote:

As noted in Chapter 1, reducing the statutory rate of corporate income tax has been the most popular government tax reform in the period.However in most of the economies, the case study company does not pay corporate income tax at the statutory rate on its profit before tax, since the tax rules require adjustments to be made to this in order to calculate taxable profits. A common example is to substitute tax depreciation for commercial amortisation of assets.

The effective rate of current corporate income tax can be defined as the actual rate of corporate income tax paid as a percentage of profit before tax. Figure 2.7 compares this effective rate with the statutory rate of corporate income tax for the G8 and BRIC (Brazil, Russia, India and China) economies, and shows that the two are often not the same...

["Paying Taxes 2009: The Global Picture," World Bank,

11/10/08; in-text citation removed for clarity]

CBPP: U.S. Corporations Pay Lower Taxes Than Average For Developed Economies. According to the Center for Budget and Policy Priorities: "The U.S. corporate tax burden is smaller than average for developed countries. Corporations in 19 of the member states of the Organization for Economic Co-operation and Development paid 16.1 percent of their profits in taxes between 2000 and 2005, on average, while corporations in the United States paid 13.4 percent." [CBPP.org,

10/27/08; in-text citation removed for clarity]

2009: General Electric Earned A $1.1 Billion Tax CREDIT Despite $10.3 BILLION In Pre-Tax Income. According to

Forbes: "As you work on your taxes this month, here's something to raise your hackles:

Some of the world's biggest, most profitable corporations enjoy a far lower tax rate than you do--that is, if they pay taxes at all. The most egregious example is General Electric

. Last year the conglomerate generated $10.3 billion in pretax income, but ended up owing nothing to Uncle Sam. In fact, it recorded a tax benefit of $1.1 billion. Avoiding taxes is nothing new for General Electric. In 2008 its effective tax rate was 5.3%; in 2007 it was 15%. The marginal U.S. corporate rate is 35%." [

Forbes,

4/1/10; emphasis added]

Greg Taylor's case was one of more than 230 in which an auditor found significant problems.

Greg Taylor's case was one of more than 230 in which an auditor found significant problems.